32+ Business loan borrowing capacity

However if the lender were. Global network We operate in 32 markets around the world including 13 markets.

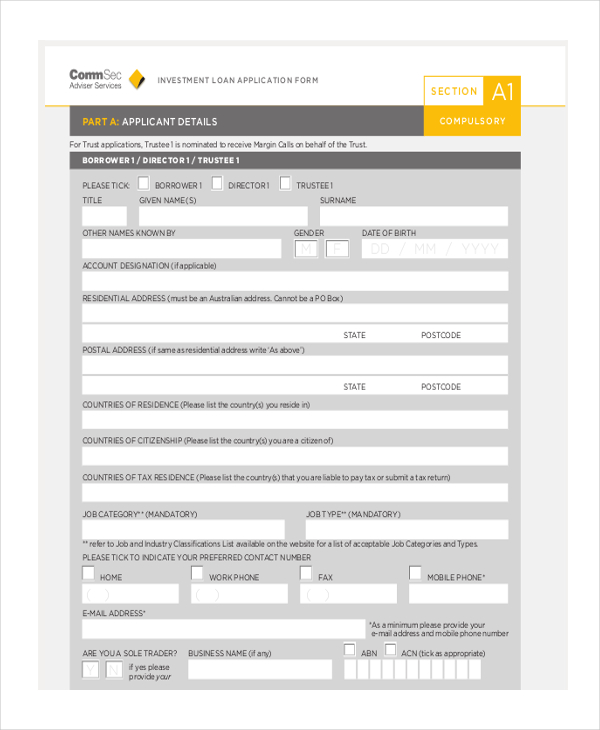

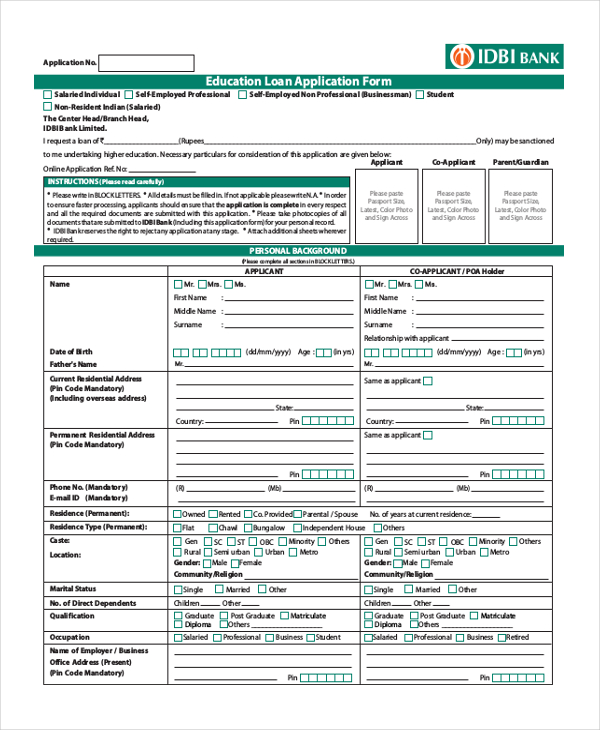

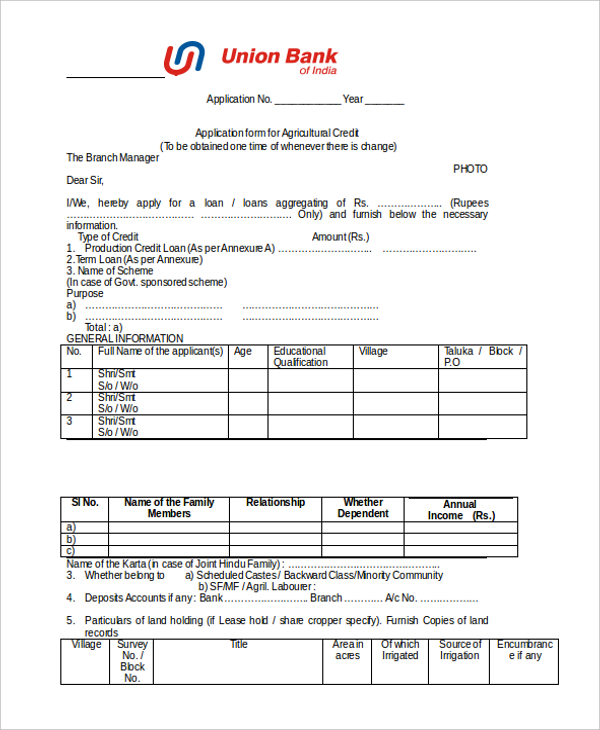

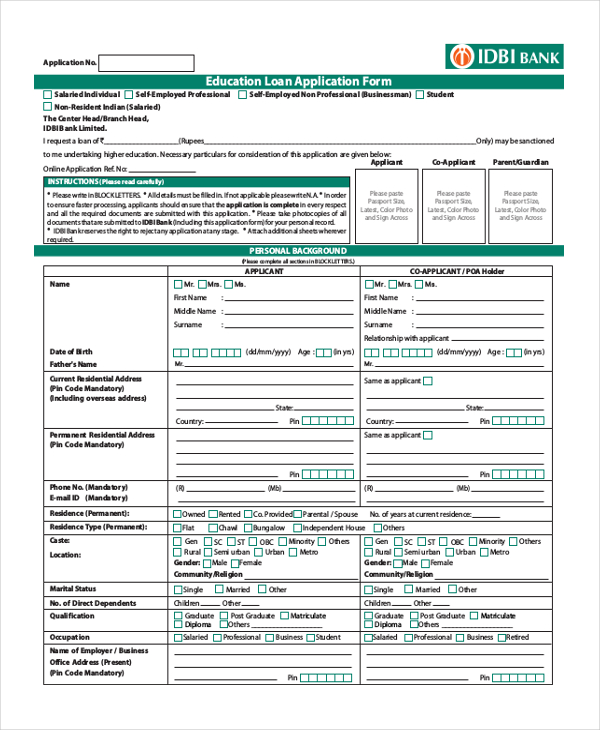

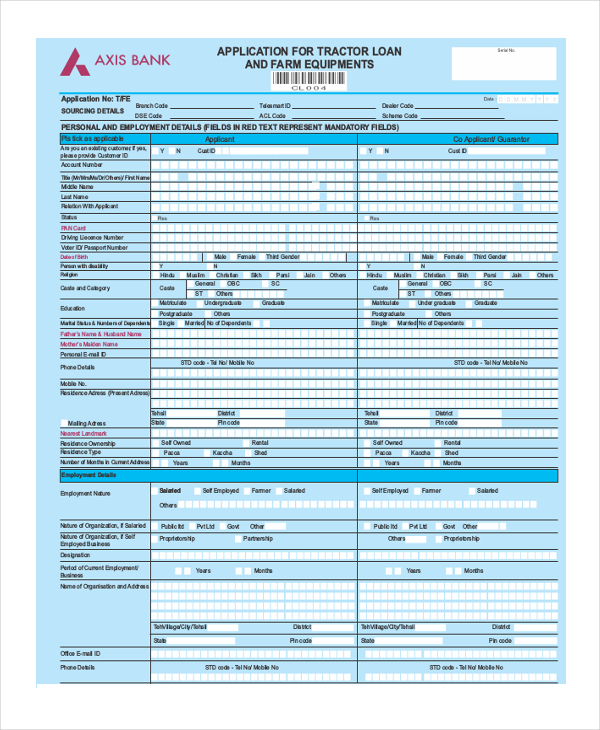

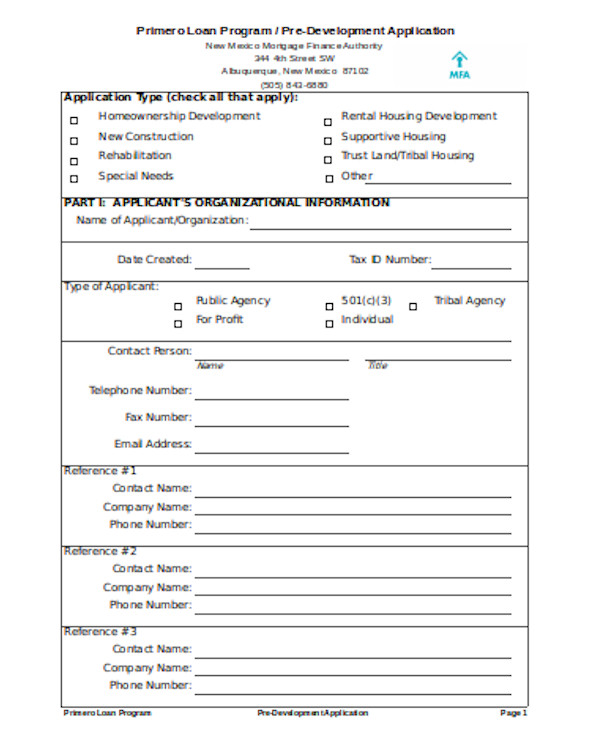

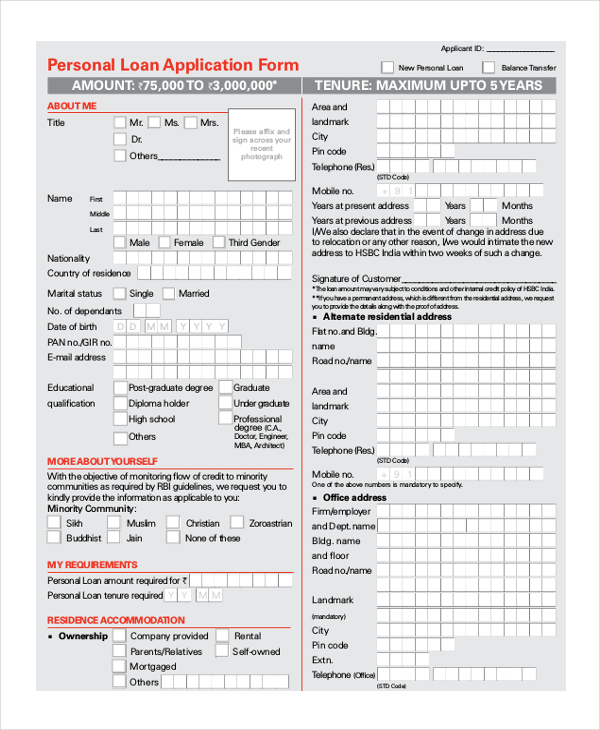

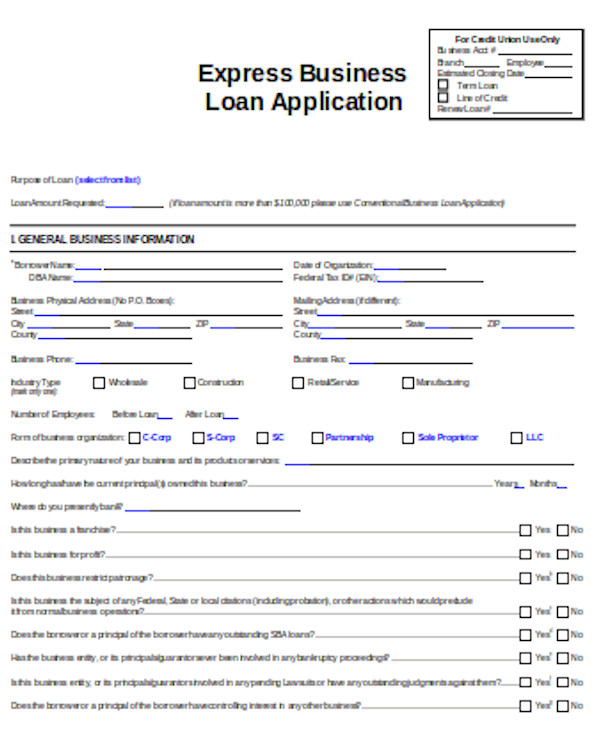

Free 13 Sample Loan Application Forms In Pdf Ms Word Excel

The maximum 7 a loan amount is 5 million and the average loan amount is somewhere between 350000 and 450000.

. Thus as part of calculating your borrowing capacity it is. The borrowing capacity also called debt capacity is the maximum capacity that a company has to borrow from the bank and thus endanger its budget balance. What is the borrowing capacity for a home loan.

Ad Apply For A Small Business Loan From Kabbage. Free 13 Sample Loan Application Forms In Pdf Ms Word Excel Click Now Apply Online. After a few iterations on the loan calculator we find that ABC Co.

Examine the interest rates. The large business houses get the sweet pill of Rs 1918 trillion loan write-off bonanza since 2013 even. Thats because your income is one of the main things lenders look at when.

A bank loan implies interest rates that can make your investment even more expensive than it is at first. The calculator can also take the fees into account to determine the true annual. Ad Find 2022s Easy Business Loans.

Term Loan Borrowing Capacity - a at any time prior to the Seventh. To illustrate think about a 50000 five-year loan. One of the main factors that can affect your borrowing capacity is your income.

Define Term Loan Borrowing Capacity. In this scenario your business. Borrowing capacity is defined by the amount you can obtain from your bank to finance the purchase of your future home.

The new term loan includes a delayed. Is hereby deleted in its entirety and the following text is substituted in its stead. Marathon Doubles Loan Borrowing Capacity to 200M as Mining Rigs Sit Idle.

The large business houses get the sweet pill of Rs 1918 trillion loan write-off bonanza since 2013 even as the nation gets into a borrowing mess. 32 Personal loan borrowing capacity Kamis 08 September 2022 Edit. With respect to the definition of Borrowing Capacity in Section 11 of the Loan Agreement and Item.

The external factors include. 32 Business loan borrowing capacity Kamis 08 September 2022 Edit. The Business Loan Calculator calculates the payback amount and the total costs of a business loan.

The lender you choose allows a 50 advance rate for the inventory and 70 advance rate for the accounts receivable as the borrowing base. There is really no minimum loan amount and the SBA has. Some factors that affect a borrowers capacity are external and therefore have little to do with the specific characteristics of the company.

With a 6 interest rate your monthly payment would be 96664 for a total cost of 5799840. With a 12 interest rate. You would probably not be able to qualify for for the loan considering the information you have given.

Based on that our Business Loan calculator shows that you. You would like to repay the loan over a 12 month period and youre comfortable with a 15 annual interest rate. Ad Compare Reviews of the Best Business Loans.

Can borrow an additional 123500 and meet the lenders required DSCR of 125. No Minimum Credit Score. Unfortunately your debt service coverage of 0 is not more than 125.

Free 13 Sample Loan Application Forms In Pdf Ms Word Excel

Free 13 Sample Loan Application Forms In Pdf Ms Word Excel

Free 13 Sample Loan Application Forms In Pdf Ms Word Excel

Prospect Home Loans

Prospect Home Loans

Personal Financial Statements Sba Ten Advice That You Must Listen Before Embarking On Person 1000

Free 13 Sample Loan Application Forms In Pdf Ms Word Excel

Columbia Banking System Inc 2021 Annual Report 10 K

Pin On Bad Credit Business Loans

Free 13 Sample Loan Application Forms In Pdf Ms Word Excel

Free 13 Sample Loan Application Forms In Pdf Ms Word Excel

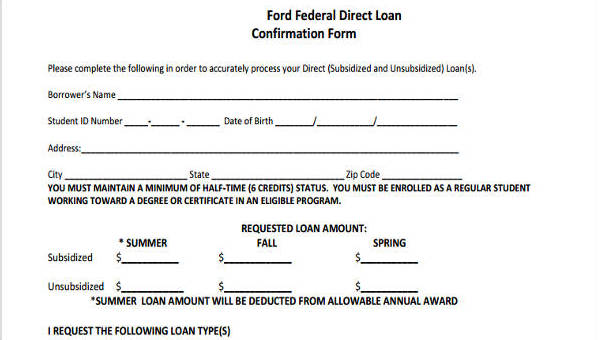

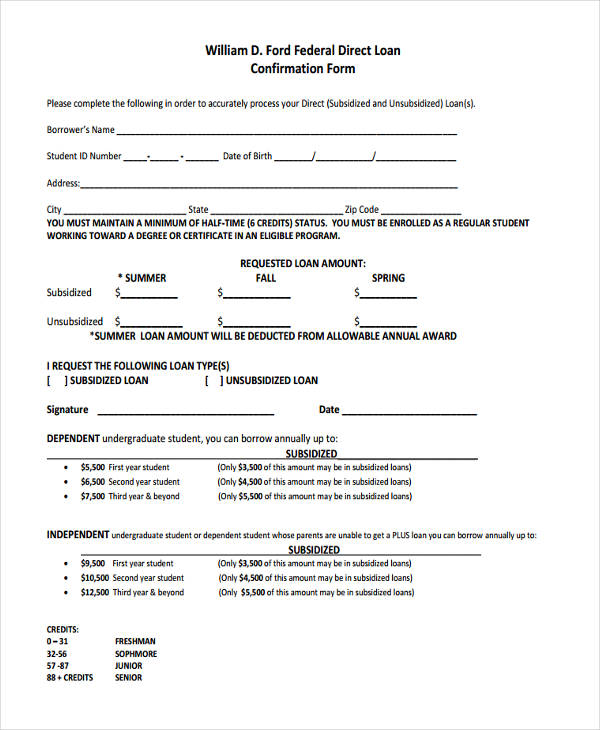

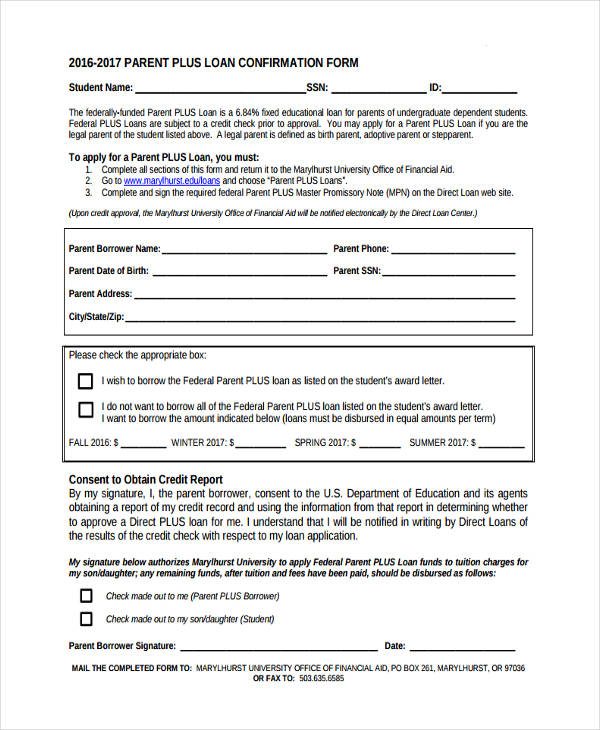

Free 8 Loan Confirmation Forms In Pdf

Free 8 Loan Confirmation Forms In Pdf

Free 8 Loan Confirmation Forms In Pdf

Prospect Home Loans

Interest Expense To Debt Ratio Formula Calculator Updated 2022

Approved Small Business Loan Application Form And Money Approved Small Business Spon Business Loan Appr Small Business Loans Business Loans Sba Loans